According to the AMIS May Month report, conditions are favourable for wheat, maize, and rice, while mixed for soybeans.

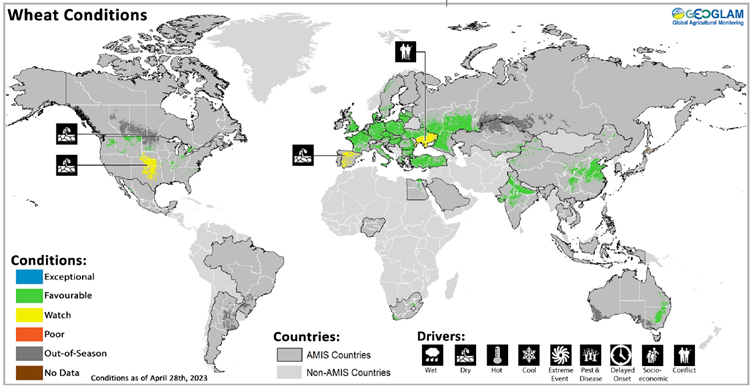

- For wheat, conditions are generally favourable in the northern hemisphere except in parts of Europe, Ukraine, and the US.

- In the northern hemisphere, winter wheat is under favourable conditions except for in parts of Ukraine, Spain, and the US. In the southern hemisphere, sowing is beginning in eastern Australia.

- In the EU, conditions are generally favourable except for Spain, where the crop could reach failure if rainfall does not return by the end of May.

- In the UK, conditions are favourable. In Türkiye, conditions are generally favourable, with recent above-average temperatures and abundant rainfall supporting the crop.

- In Ukraine, recent rainfall has improved soil moisture conditions and removed areas of drought. However, the ongoing war continues to impact the east and south regions.

- In the Russian Federation, conditions are favourable for winter wheat and the beginning of spring wheat sowing in the Volga district.

- In China, conditions are favourable as winter wheat enters the reproductive stage and sowing of the spring wheat begins. In India, harvesting is wrapping up under favourable conditions.

- In the US, the prolonged drought in the central and southern Great Plains continues to impact winter wheat. Sowing of spring wheat is beginning in the Pacific Northwest.

- In Canada, winter wheat conditions are generally favourable.

- In Australia, sowing is beginning under favourable conditions in Queensland and New South Wales.

World supply-demand outlook

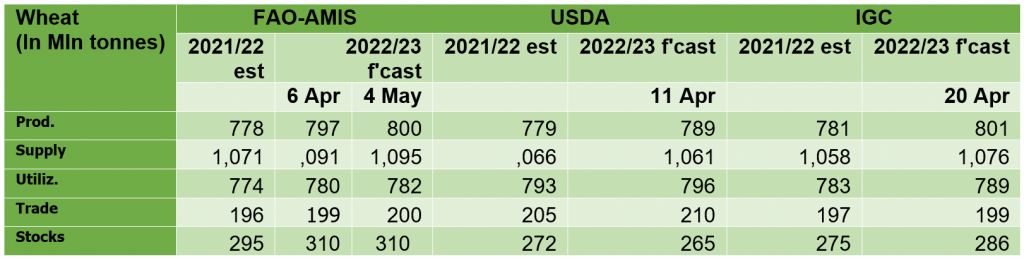

- WHEAT 2022 production scaled up further with an upward adjustment to Kazakhstan’s harvest estimate, bringing the global output to 2.9 percent above the 2021 level.

- Utilization in 2022/23 lifted this month, largely on higher utilization in India and the EU, and now rising by 1.0 percent above the 2021/22 level underpinned by growth in food, feed, and other uses.

- Trade in 2022/23 (July/June) up slightly m/m mostly on strong pace of purchases by the EU, as well as China, and higher sales foreseen for the Russian Federation, which offset a cut to India’s export forecast.

- Stocks (ending in 2023) still set to rise above opening levels, by 5.2 percent, and unchanged this month as higher inventories in Kazakhstan (on account of higher production) were balanced by downgrades for stocks in the Russian Federation (on account of higher exports).

International prices

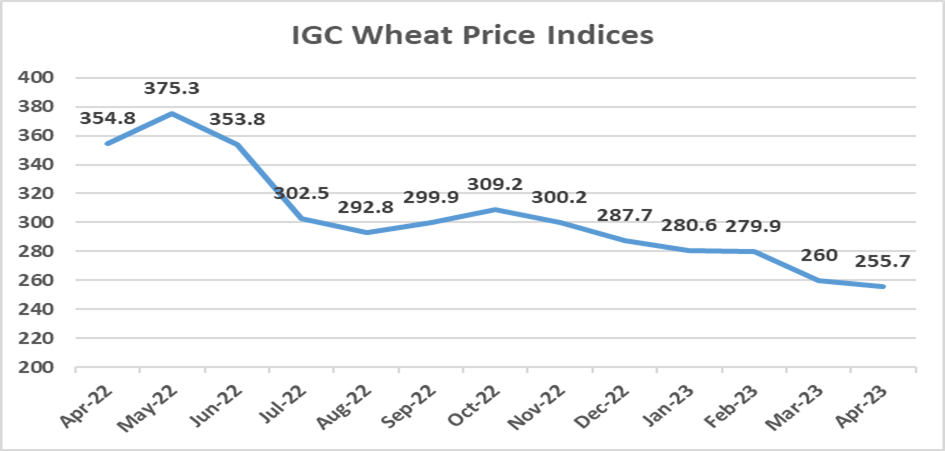

Although the GOI wheat sub-Index averaged 2 percent lower month-on-month, underlying export prices saw sharp two sided swings amid conflicting fundamentals, namely competition from Russian supplies and uncertainty about shipments from Ukraine. With recent weakness also linked to limited international buying interest, the sub-Index touched its lowest since July 2021. Slow export demand remained a bearish influence for US prices, while much-needed rains across the US Plains added pressure. EU values dropped on mostly favourable new crop prospects. Russian prices were nominally little changed amid steady export progress. Quotations in Ukraine were ill-defined, with business hampered by confusion about the duration of the Black Sea Grain Initiative, halts to vessel inspections in Turkey, and restrictions on Ukrainian exports by some EU members.

Futures prices

Grain and soybean prices displayed a downward trend in April, with wheat reaching a 21-month low. In wheat markets, uncertainties concerning the future of the Black Sea Grain Initiative and the ban on Ukrainian grain imports of several Eastern European countries failed to lift values. Instead, market participants seem to expect abundant availability. The Russian Federation, in particular, continues to provide ample supplies to international markets, despite a somewhat slower export pace in April. Conditions for the new wheat crop are overall favourable, with some spot concerns mainly for Hard Red Winter growing regions near Kansas that have led to higher price premiums for high protein wheat.

Policy Developments

- On 12 April, Egypt approved an increase in the wheat procurement price for the upcoming season. The new purchase price paid to farmers is EGP 1 500 per ardeb (USD 325 per tonne), an increase of 20 percent from the previous price of EGP 1 250 per ardeb (USD 270 per tonne) announced last January (see AMIS Market Monitor February 2023).

- On 11 April, India removed the 20 percent export duty on seed-quality rice that was introduced in September 2022 (see AMIS Market Monitor October 2022) given the improved level of rice stocks.

- On 13 April, India relaxed wheat procurement quality norms for regions where crops were damaged by heavy rains and winds (Punjab, Haryana and Rajasthan).

- On 10 April, the Ministry of Agriculture in Kazakhstan introduced a ban on the import of wheat by road from third countries (including those of the Eurasian Economic Union), for a period of six months.

- On 8 March, the Ministry of Agriculture, Food and Rural Affairs in South Korea released a plan aiming to boost domestic wheat production. The plan outlines several actions to achieve this goal, including expanding the volume of wheat procured under the country’s public stockholding programme, and establishing a system of advance procurement of wheat stocks for the following year before sowing takes place.

Source: AMIS: The above is an extract from the AMIS May 2023 market monitor published this week. It covers international markets for wheat, maize, rice and soybeans. This extract relates to Wheat only. To read the complete edition click here.